Get Help With Refinancing

Our Mortgage Broker Service is FREE to you

Free discussion limited to issues about your finances

What is refinancing?

Refinancing is a process where a mortgage is changed from one lender to another.

However, in the context of separation, it normally involves:

- a mortgage in joint names being transferred to one person's sole name, and

- title to the house being changed from joint names to one person's sole name.

Another less common situation can be where title is transferred from one person's sole name to another person's sole name as well as the mortgage.

When a refinance occurs, the old mortgage is discharged, e.g. cancelled, and a new mortgage is created. When a mortgage is discharged, a person who is under the old mortgage is released from liability.

Why You Cannot Own Assets With Your Ex

If you're getting separated or divorced, you can't continue to hold assets with your former partner long term. Doing so is fraught with risk.

For example, if you have a joint mortgage with your partner, then you are both jointly and severally liable for the mortgage. This means that the bank can pursue you both individually for 100% of the mortgage.

If your partner stops paying the mortgage after separation because they moved on with life, they lost their job, they stopped caring, or whatever other reason, you'll be liable for the entire mortgage. It is your credit record that will be affected.

It's certainly common for couples who are separating to continue owning joint debts and assets in the short term post separation, e.g. under 12 months during the transition period. However it is rare for couples who have separated to hold assets long term.

You need to sever all of your assets and debts so you can both move on with life without having the other person as a joint owner. This allows you both to build your wealth individually from each other.

Consent Orders and Binding Financial Agreements

After you've reached an agreement on how to divide your assets and debts, you need to make it legally binding. The only two ways to make an agreement legally binding are through consent orders or a binding financial agreement (BFA).

Consent orders

They are lodged with the court, but court attendance is not required

The court reviews and approves the division of assets and debts to ensure a party is not unfairly disadvantaged

Does not require each person to get independent legal advice

Are normally more cost-effective than a BFA

Are suitable for most couples splitting assets and debts

A binding financial agreement

It's kept out of court

Is a private contract

Requires both people to get their own independent legal advice. Each person’s lawyer needs to sign a certificate confirming the lawyer has given legal advice.

Is suitable for situations that involve complexity, urgency or a situation where the asset split is unfavourable to one party

You Need Consent Orders/ BFA For Refinancing

In order to refinance, the bank will require consent orders or a binding financial agreement to be provided in order to finalise the loan.

You can start the loan process now, and once the loan is conditionally approved, you normally have 90 days to send the consent orders or a BFA to the bank.

Stamp Duty Savings

Consent orders and BFAs also have the added advantage of saving stamp duty.

If you're transferring title from joint names to one person's name, normally stamp duty is charged on 50% of the value of the property. So for example if your property is worth $600,000 then you’ll need to pay stamp duty on $300,000 (to transfer title from joint names to a sole name). That would be approximately $8,800.

However, with consent orders and BFAs, stamp duty is reduced to virtually nothing, e.g. there's a $20 nominal payment. So you’ll save many thousands of dollars getting consent orders or a BFA done (as well as making your agreement legally binding).

HOUSE

$600,000

YOUR HALF TO PARTNER

$300,000

FORMER PARTNER

ESTIMATED STAMP DUTY

$8,800

You Need to Divide Everything

Remember, when you're separating, you can't just divide the house, you need to divide all your assets and debts including super, furniture, cars, money in bank accounts, shares, overseas pensions, etc.

However, the house is often the most important and valuable asset, so couples often start discussing that first.

You can start the process by speaking to a mortgage broker before you've decided on how to divide your other assets and debts.

However, before the consent orders or BFA is prepared, you will need to reach an agreement on how everything else is divided.

It's a good time to start speaking with a mortgage broker when you've made a decision on who will likely keep the house.

Equity In The House

If you or your partner own real estate, you need to understand equity. Equity is the difference between the current value of the house and the current outstanding mortgage. It is basically the amount of money you would get if you sold your house and paid off the mortgage (less sales fees etc).

Current Property Value

EXAMPLE

$600,000

Outstanding Mortgage

EXAMPLE

$400,000

Property Equity

EXAMPLE

$200,000

How Equity Impacts Refinancing?

Equity is an important consideration when you're going through the refinancing process following a separation (eg you wish to transfer both the title and the mortgage into your sole name).

The amount of equity in the house impacts a person's ability to borrow in the following ways:

- The more equity you have in the property, the easier it is to borrow and the better rate you can get from the bank.

- If you have less than 80% equity in the property (e.g. house value divided by the mortgage amount), then the bank may require you to obtain lender's mortgage insurance. This is insurance which covers the bank in case of a default. There is an extra cost added to the mortgage to account for this.

Our mortgage brokers can give you an idea of what your house is worth because we have access to the valuation portals used by the banks.

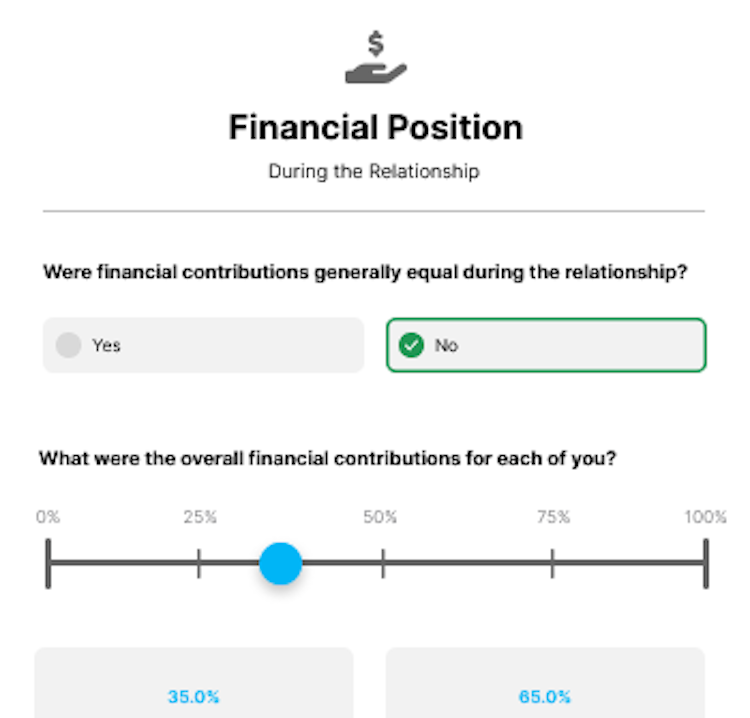

How Equity Determines The Payout Figure?

Another important reason to understand equity is because it’s used as a starting point to discuss a payout figure to the spouse who is giving up their interest in the house. For example, the person keeping the house might pay some money to the other person. The amount of this payout is influenced by the amount of equity in the house.

You might, for example, decide to split the equity in the house 50/50 (but remember you don’t have to split everything 50/50 and each case is unique). If there’s $200,000 of equity in the house, then the payout figure from the person keeping the house to the other person would be $100,000.

Typical Process When Refinancing

- 1

Discuss Short Term Things

Initially, after separation, you would normally discuss short-term things such as:

- living arrangements, e.g. whether you'll continue living under one roof or whether one of you will move out;

- how you’ll pay the mortgage in the short-term;

- payment of bills, school fees, rates etc in the short-term.

- 2

High Level Discussion About Assets & Debts

Then couples generally have a robust discussion about how they're going to split the assets and debts. This can begin as a high level discussion on the big items (eg house and super).

An important part of the discussion will involve whether you're going to keep the house, or sell it. Many people want to keep the house for various reasons, including providing stability for children and just avoiding the hassle of moving.

Couples will often have discussions about a payout figure, e.g. how much the person keeping the house will pay to the other person.

You don’t need to agree to everything at this stage. - 3

Speak To A Broker

Once you've decided who will likely keep the house, then it’s a good idea to speak to a mortgage broker to verify borrowing capacity and investigate potential loans.

Remember, you can also borrow the payout figure to pay-out your former partner. - 4

Pre-Approval (optional)

The next step is obtaining pre-approval. This is where the bank will review your mortgage application and approve it subject to certain conditions. One of the main conditions is obtaining consent orders or a BFA.

Pre-approval lasts 90 days. This means you’ll have 90 days to get the consent orders or a BFA to the bank. - 5

Get Consent Orders / BFA

As mentioned, you’ll need to get consent orders approved or a BFA signed. MKI Legal can assist with this step as well as helping you obtain the mortgage.

At this step, you’ll need to finalise your agreement on how you’re going to divide all your assets and debts. - 6

Settlement

If you haven’t got pre-approval, then at this step you’ll apply for the loan and then proceed to settlement after you’ve been approved.

Usually after consent orders are issued or BFA signed, then settlement occurs.

At settlement, the following happens:

- The old mortgage is discharged and the new mortgage is created.

- Title is actually transferred from joint names to a person’s sole name (or from sole name to sole name).

- Settlement is when the payout figure is made to the other person.

You normally need to engage a settlement agent to prepare the documents necessary to transfer title from joint names to sole name.

Accredited Mortgage Brokers Here To Help

Get help from an accredited mortgage broker. No cost to you.

Chris Keating

DIRECTOR OF KEATING FINANCE

- MKI Legal has partnered with Chris from Keating Finance to help deliver mortgage assistance.

- Chris has over 15 years in the finance broking industry.

- Registered with Mortgage & Finance Association of Australia

Chris is an accredited mortgage broker with years of experience helping people navigate their refinance journey during a separation.

Nicholas Marouchak

DIRECTOR OF MKI LEGAL

- Lawyer with over 15 years experience

- Accredited mortgage broker

- Registered with Mortgage & Finance Association of Australia

Nicholas is both a lawyer and mortgage broker. He helps people navigate both the refinancing side and legal side of separating.

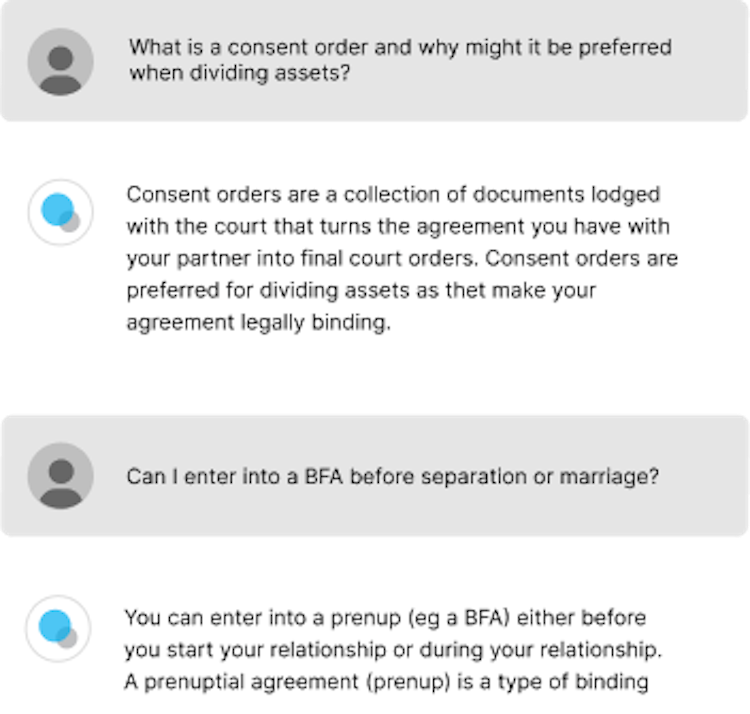

Get More Family Law Assistance With AI

LawAI

LawAI is a helpful and informative AI chat bot that specialises in family law enquiries.

Ask questions about dividing your assets and debts, consent orders, prenups, binding financial agreements, refinancing etc.

In-depth knowledge about different types of situations based on all the information on our website.

Easy to use and it’s free.

Caution should be taken when using LawAI as it can give incorrect information. Consider checking important information. LawAI is not a substitute for legal advice.

MKI Legal has been featured by these publications